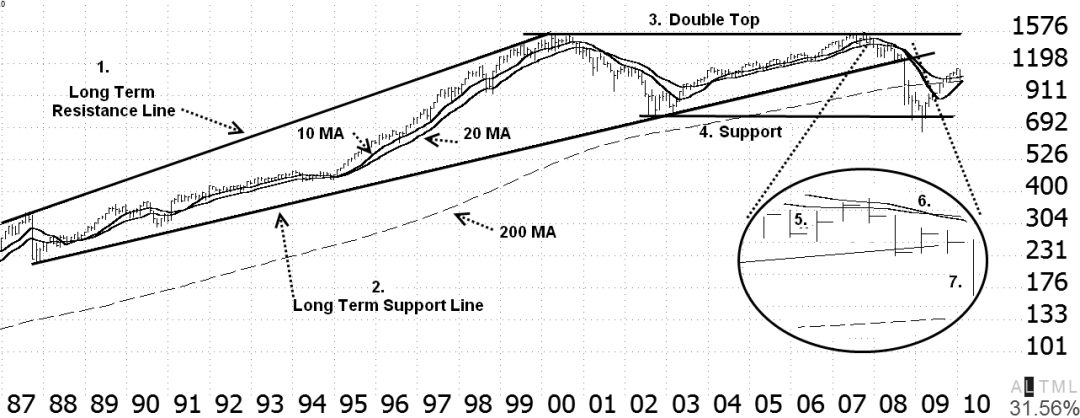

Stock Market Analysis Details

Two years ago, during a brief window of time in October 2008, there

were a few days when the sudden and unexpected explosion of the

Sub-Prime Mortgage Crisis was so intense that many leading economists

and experts questioned whether the entire modern financial system

may collapse. Banks rely on the ability to borrow funds from each

other in order to finance day-to-day operations, but after the failure

of Lehman Brothers, the interbank credit market froze up.Banks are not the only business institutions that rely on credit in order to sustain daily cash flow levels, and when the interbank credit market froze in October 2008, businesses around the world nearly failed. In fact, if the credit markets had not loosened a little, chances are strong that, indeed, the entire global financial system would have failed.

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

Stock Market Analysis

No comments:

Post a Comment