Short Term Trading Details

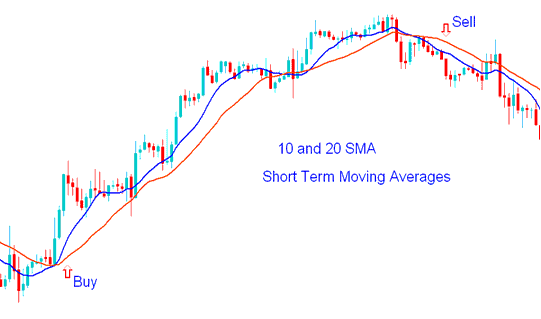

Short-term trading refers to those trading strategies in or futures market in which the time duration between entry and exit is within a range of few days to few weeks.Watching

whether a stock is trending up or down can be a sure sign as to sell or

buy in the short run. This is called the moving average or the average

price of a stock over a specific period of time. As a stock is trending

upward throughout a day or two it could be an opportunity for gains and

as a stock trends downward it could be a great opportunity to short the

stock. Many analysts use chart patterns in an attempt to forecast the

market. Formulas and market theories have been developed to conquer

short term trading. According to Masteika and Rutkauskas (2012), when

viewing a stock’s chart pattern over a few days, the investor should buy

shortly after the highest chart bar and then place a trailing stop

order which lets profits run and cuts losses in response to market price

changes (p. 917-918). Historically, on average the stock markets lowest weekday is Mondays

which offers a potential sale on any given stock (Lynch, 2000)

. Along with that, since 1950 most of the stock market’s gains have

occurred from November to April. Investor’s can use these known trends

and averages to their advantage when trading.

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

Short Term Trading

No comments:

Post a Comment